Some say that the era of becoming rich overnight through crypto mining is over, but it is still a good investment option. Companies like Marathon (MARA), Riot (RIOT), and CleanSpark (CLSK) are frequently "scooping up" equipment, leading to a shortage of mining rigs. At the same time, manufacturers like BITMAIN, MicroBT, and IceRiver are increasing their R&D investments and have launched several new ASIC mining rigs this year. All of this seems to confirm that the crypto mining market is still thriving.

According to blockchain explorer data, this year has seen Bitcoin, Litecoin, and Kaspa—several major PoW coins—reach all-time highs in total network hashrate, indicating that the scale of crypto mining is expanding. Miners are actively entering the market in preparation for the next bull market. However, as the hashrate climbs, the competition in this "Hunger Games" becomes increasingly intense. Mining rigs are akin to "weapons," and only those with efficient equipment can enhance their survival odds in this arena. This article will explore the latest earnings from mining rigs in 2024, offering diverse data references to deepen your understanding of market trends.

Before discussing mining rigs, it’s essential to understand that the two key indicators in the ASIC mining rig field are hashrate and power efficiency. Hashrate indicates the number of hash calculations performed per second, typically measured in hashes per second (H/s). Power efficiency refers to the number of hashes performed per unit of power consumed, expressed in joules per hash (J/H). The higher the hashrate and the lower the power consumption, the more competitive the mining rig is.

*Below, different mining rigs will be introduced by coin type.

Bitcoin (BTC) Mining Rigs

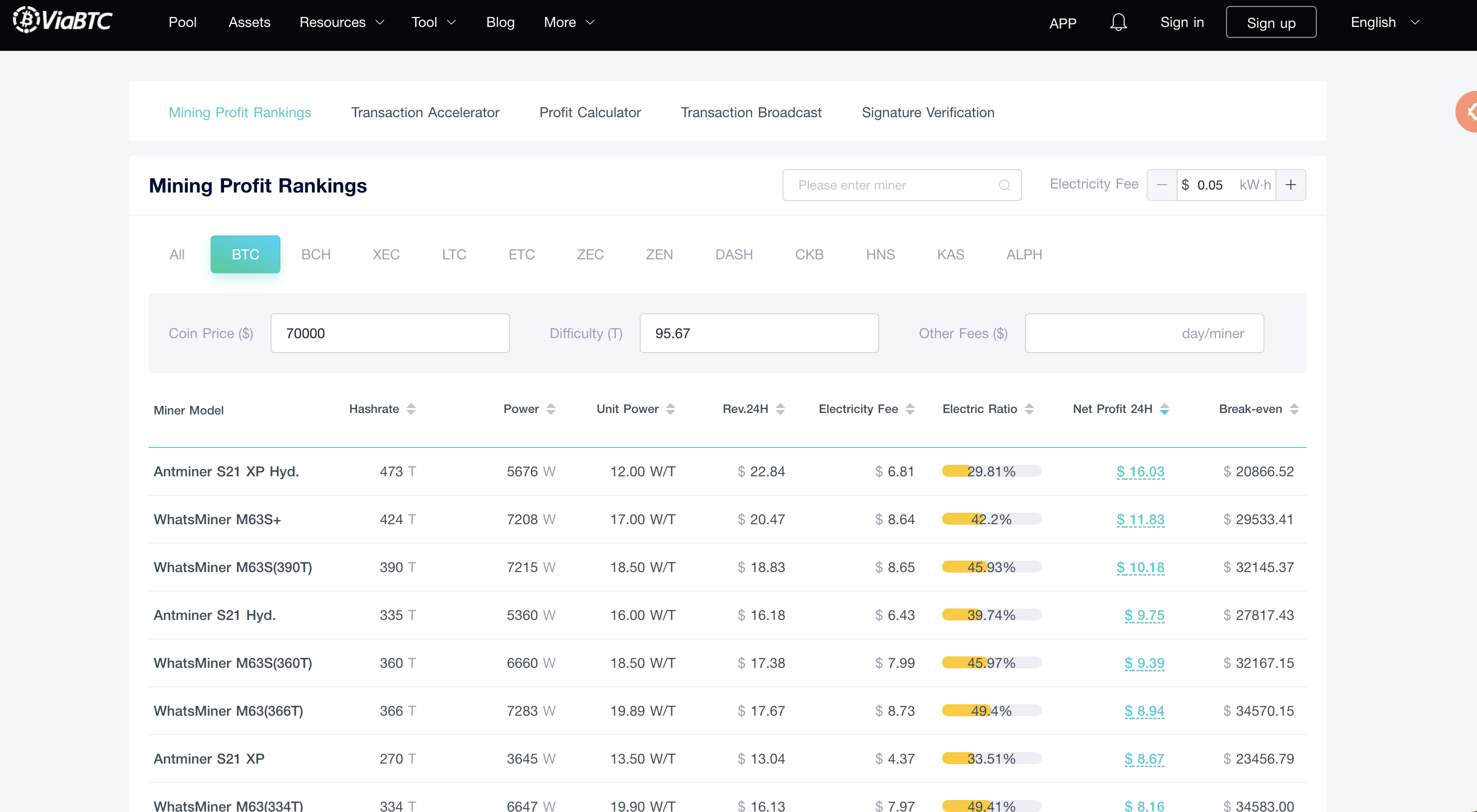

Bitcoin mining rigs refer to ASIC mining rigs specifically designed for Bitcoin's SHA256 algorithm. These machines also support mining other coins based on the SHA256 algorithm, such as Bitcoin Cash (BCH) and eCash (XEC). For simplicity, we will calculate the earnings based on BTC. The following calculations are based on a BTC: $70,000, an electricity cost of $0.05/kWh, and a current mining difficulty.

- Antminer S21 XP Hyd.

Hashrate: 473 TH/s

Power: 5676 W

Power efficiency: 12 J/T

Electricity fee: $6.81

Rev.24H: $22.84

Net Profit 24H: $16.03

- WhatsMiner M63S+

Hashrate: 424 TH/s

Power: 7208 W

Power efficiency: 17 J/T

Electricity fee: $8.64

Rev.24H: $20.47

Net Profit 24H: $11.83

- WhatsMiner M63S

Hashrate: 390 TH/s

Power: 7215 W

Power efficiency: 18.5 J/T

Electricity fee: $8.65

Rev.24H: $18.83

Net Profit 24H: $10.18

- Antminer S21 Pro

Hashrate: 234 TH/s

Power: 3531 W

Power efficiency: 15 J/T

Electricity fee: $4.23

Rev.24H: $11.3

Net Profit 24H: $7.07

In fact, some mining pools offer merged mining services for BTC, FB, and other coins. For example, miners mining BTC in the ViaBTC pool can also earn a portion of FB, NMC, SYS, and ELA as additional rewards. Therefore, the actual daily net profit for BTC miners participating in merged mining is typically higher than the calculated results above.

Litecoin (LTC) Mining Rigs

Litecoin mining rigs are ASIC devices designed specifically for Litecoin's Scrypt algorithm, and the Litecoin project has supported merged mining from the beginning. Currently, mining LTC can yield rewards in FB and BEL, with these additional earnings sometimes exceeding the LTC earnings themselves. The following calculations are based on an LTC: $69.2, a DOGE: $0.162, a BEL: $1.34, an electricity cost of $0.05/kWh, and a current mining difficulty.

- Antminer L9

Hashrate: 16 GH/s

Power: 3360 W

Power efficiency: 210 J/G

Electricity fee: $4.03

Rev.24H: $34.18(0.047 LTC+171.3 DOGE+2.37 BEL)

Net Profit 24H: $30.15

- Elphapex DG1+

Hashrate: 14 GH/s

Power: 3920 W

Power efficiency: 280 J/G

Electricity fee: $4.74

Rev.24H: $29.91(0.041 LTC+149.8 DOGE+2.07 BEL)

Net Profit 24H: $25.17

- Elphapex DG1

Hashrate: 11 GH/s

Power: 3420 W

Power efficiency: 311 J/G

Electricity fee: $4.1

Rev.24H: $23.43(0.032 LTC+117.8 DOGE+1.62 BEL)

Net Profit 24H: $19.33

- Antminer L7

Hashrate: 9.5 GH/s

Power: 3425 W

Power efficiency: 361 J/G

Electricity fee: $4.11

Rev.24H: $20.19(0.028 LTC+101.7 DOGE+1.4 BEL)

Net Profit 24H: $16.08

Kaspa (KAS) Mining Rigs

Kaspa mining rigs are ASIC mining rigs designed for Kaspa's kHeavyHash algorithm. These machines also support mining other coins based on the kHeavyHash algorithm, such as SedraCoin (SDR) and Bugna (BGA). For simplicity, we will calculate the earnings based on KAS. The following calculations are based on a KAS: $0.116, an electricity cost of $0.05/kWh, and a current mining difficulty.

- Antminer KAS5 Pro

Hashrate: 21 TH/s

Power: 3150 W

Power efficiency: 150 J/T

Electricity fee: $3.78

Rev.24H: $17.41

Net Profit 24H: $13.63

- Antminer KAS5

Hashrate: 20 TH/s

Power: 3000 W

Power efficiency: 150 J/T

Electricity fee: $3.6

Rev.24H: $16.58

Net Profit 24H: $12.98

- ICERIVER KS5M

Hashrate: 15 TH/s

Power: 3400 W

Power efficiency: 227 J/T

Electricity fee: $4.08

Rev.24H: $12.43

Net Profit 24H: $8.35

- ICERIVER KS5L

Hashrate: 12 TH/s

Power: 3400 W

Power efficiency: 283 J/T

Electricity fee: $4.08

Rev.24H: $9.94

Net Profit 24H: $5.86

Alephium (ALPH)Mining Rigs

APLH mining rigs are ASIC mining rigs designed for the Blake3 algorithm used by APLH. Currently, they can only mine ALPH, as there are no other similar algorithm projects available. The following calculations are based on an ALPH: $1.19, an electricity cost of $0.05/kWh, and a current mining difficulty.

- Antminer AL1

Hashrate: 16.6 TH/s

Power: 3730 W

Power efficiency: 225 J/T

Electricity fee: $4.47

Rev.24H: $36.3

Net Profit 24H: $31.83

- IceRiver AL3

Hashrate: 15 TH/s

Power: 3500 W

Power efficiency: 233 J/T

Electricity fee: $4.2

Rev.24H: $32.8

Net Profit 24H: $28.6

- Goldshell E-AL1M

Hashrate: 4.4 TH/s

Power: 1800 W

Power efficiency: 409 J/T

Electricity fee: $2.16

Rev.24H: $9.62

Net Profit 24H: $7.46

- DragonBall Miner A40

Hashrate: 3.3 TH/s

Power: 1600 W

Power efficiency: 485 J/T

Electricity fee: $1.92

Rev.24H: $7.21

Net Profit 24H: $5.29

For additional data on mining rigs, you can check the " Mining Profit Rankings" on the ViaBTC website.

Beyond the performance indicators of the mining rigs discussed, choosing the right time to purchase is crucial. In a bull market, mining rigs may offer higher profit margins, with payback periods generally ranging from a few months to a year. Conversely, during a bear market, mining profitability can drop significantly, extending payback periods to several years. Therefore, miners should keep a close eye on market trends to maximize their profitability and target the most lucrative coins to mine.

*The above content is for reference only and does not constitute investment advice.