Three months after the halving, Bitcoin's hash price hit a historic low in early July. Recently, with the rise in BTC prices, this figure has rebounded somewhat. However, this volatility has once again sparked widespread discussion about the future of miners: How will miners' sources of income evolve as Bitcoin continues to undergo halvings?

Bitcoin Ecosystem Fuels Increase in Transaction Fees

The halving mechanism undeniably controls Bitcoin's inflation rate effectively. As Bitcoin adoption rises and annual issuance decreases, the positive supply-demand dynamic continues to impact BTC's value. However, this mechanism has also made some new miners cautious about future earnings, making them hesitate before joining the mining process. In response, Bitcoin's founder Satoshi Nakamoto stated early on: "In a few decades when the reward gets too small, the transaction fee will become the main compensation for [mining] nodes. I’m sure that in 20 years there will either be very large transaction volume or no volume."

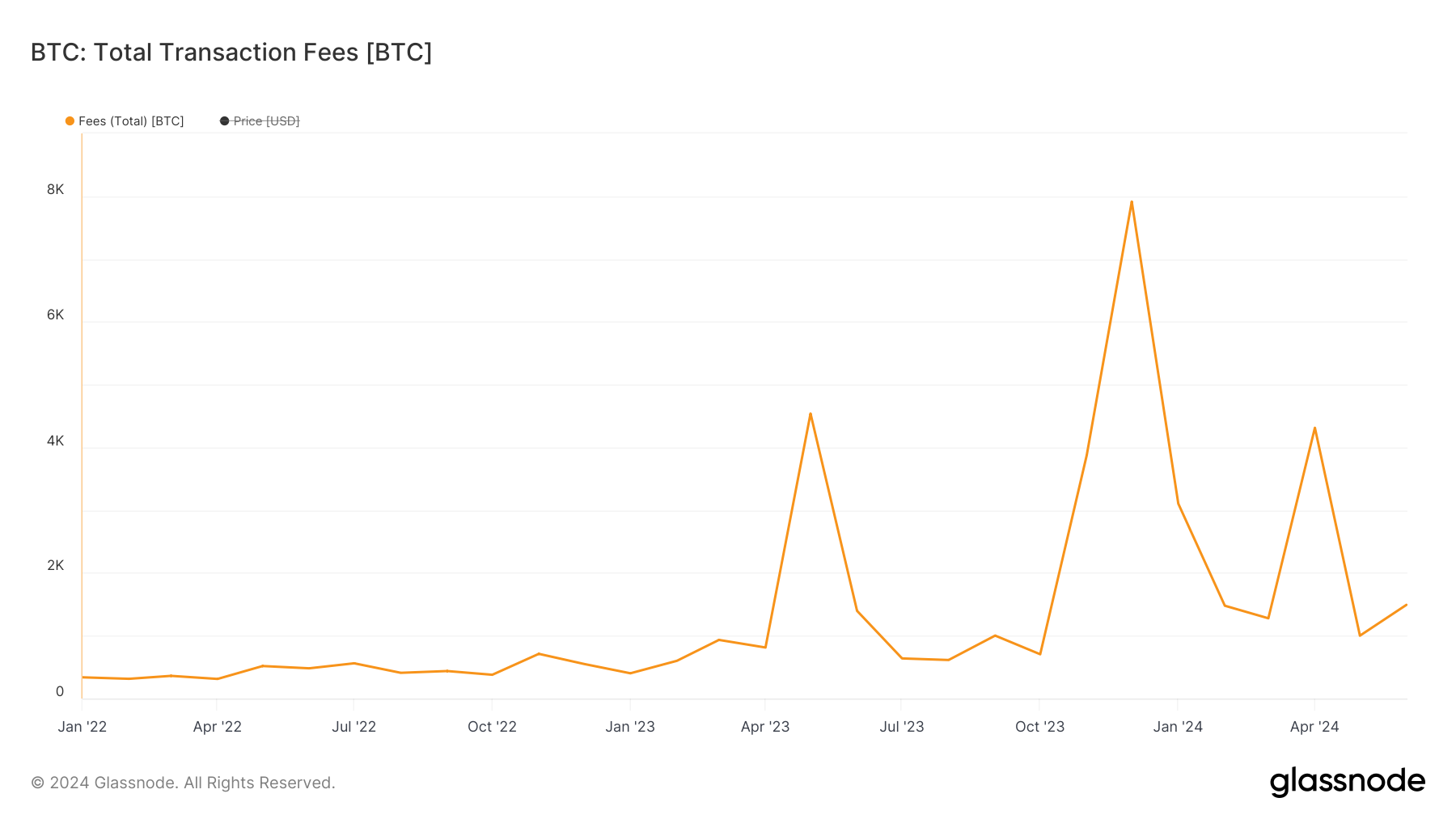

Over the past two years, the introduction and widespread adoption of new Bitcoin protocols like Ordinals, BRC-20, and Runes have significantly increased transaction fee income. According to Glassnode data, Bitcoin miners earned 5,375 BTC in fees in 2022. In 2023, with the rise in Bitcoin ecosystem applications and increased network activity, transaction fee income surged to 23,432 BTC, a growth rate of 336%. As of July 24, 2024, the Bitcoin network has provided miners with an additional 12,995 BTC in fee income.

Before the fourth halving, Bitcoin's annual output was approximately 330,000 coins. In 2023, transaction fees contributed around 7% of miners' additional revenue, valued at about $1 billion. Considering the impact of the halving, if transaction fees in the second half of 2024 remain consistent with the first half, the proportion of transaction fees in miners' total revenue is expected to continue increasing.

The Future of Bitcoin Ecosystem and Miner Revenue

Beyond directly increasing transaction fee revenue, the development of the Bitcoin ecosystem is expected to indirectly impact miners' income in various ways. For instance, since Nervos Network transitioned to BTC Layer2, its token price has nearly tripled, significantly benefiting many CKB miners.

Industry experts are optimistic about future changes in miners' income. ViaBTC, one of the world's top three mining pools, stated: "The active use of new protocols such as Ordinals, BRC-20, and Runes over the past two years has dramatically increased on-chain transaction volume. The ongoing development of the Bitcoin ecosystem, particularly at the application layer, will enhance on-chain activity and value, compensating miners for reduced rewards due to halving.

However, the Bitcoin ecosystem is still in its early stages, with non-P2P on-chain transactions showing sporadic patterns. This leads to significant fluctuations in transaction fee income. For example, in April, due to the Runes protocol, transaction fee income reached 4312 BTC, but it dropped to just 1001 BTC the following month.

To achieve a more stable income, the Bitcoin network needs to undergo a more extended period of development. If the Bitcoin ecosystem can achieve new technological breakthroughs, addressing issues like limited block space and slow transaction speeds, and introduce more use cases, on-chain activity might become robust again. By then, as Satoshi Nakamoto envisioned, transaction fees could become the primary source of income for miners.