As one of the most prominent altcoins, Litecoin (LTC) earned early recognition with the phrase "Bitcoin is gold, Litecoin is silver," leading many to view it as the "silver" of the cryptocurrency world. Over the past 13 years, Litecoin has consistently held a strong position within the crypto industry. The steady increase in its hash rate further reflects miners' enduring preference for LTC, which is closely tied to the growth in LTC's earnings.

This article will examine the annual revenues of LTC miners to understand how mining returns have changed over different periods and provide forecasts for future potential, offering valuable data for LTC miners' decision-making.

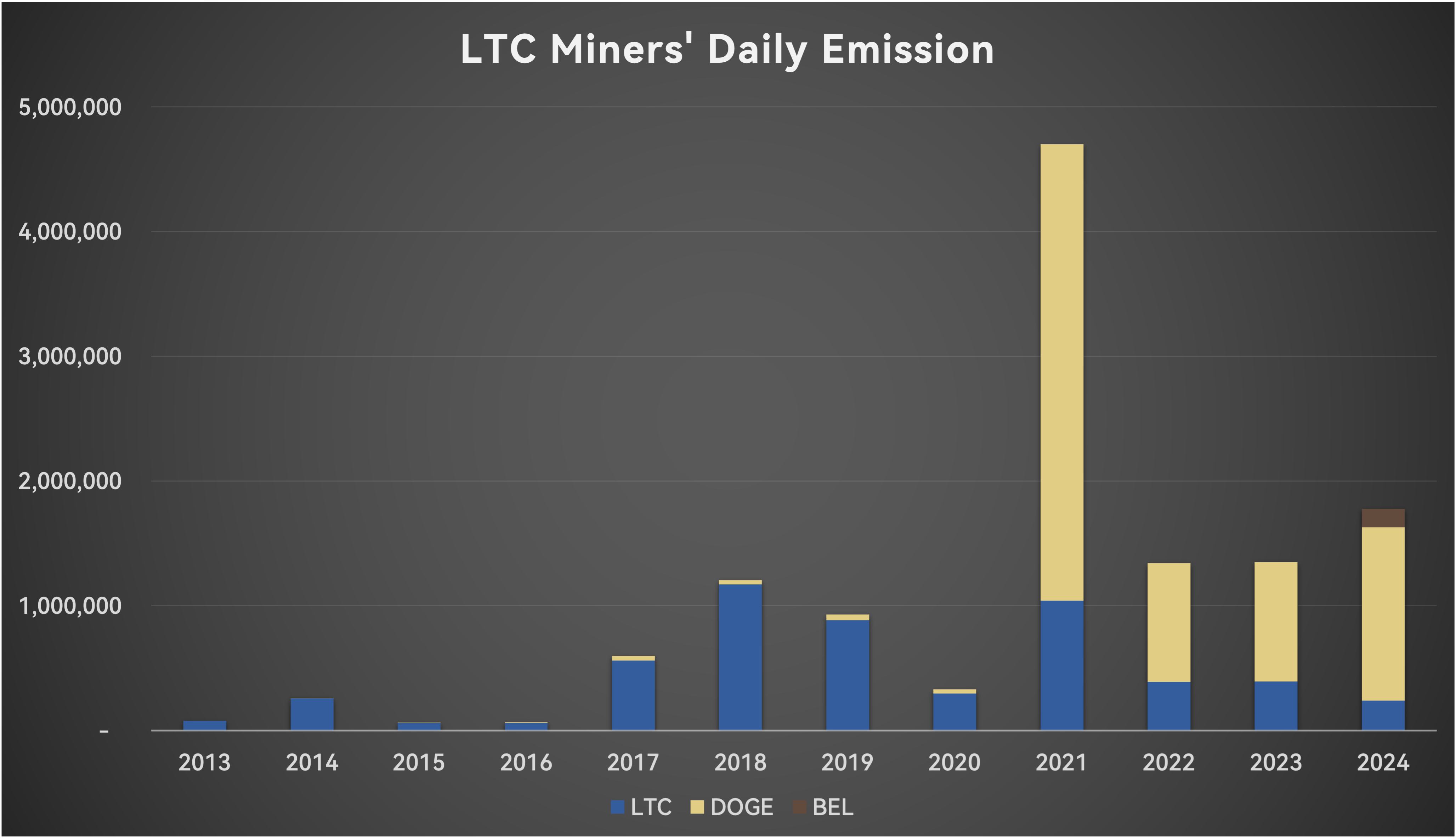

Given that LTC was an early adopter of merged mining, which has significantly impacted earnings, LTC's revenue can be categorized into several stages based on the primary sources of mining income:

- Stage 1 (2011-2020): The "Litecoin Silver" phase, characterized by earnings primarily from LTC.

- Stage 2 (2021-2023): The "Meme Coin" craze, where earnings from DOGE were predominant.

- Stage 3 (2024): The diversified revenue phase following the integration of BELLS merged mining

"Litecoin Silver" Phase

Under the slogan "Bitcoin is gold, Litecoin is silver," Litecoin has been recognized as one of the most promising altcoins since its launch, with its price and hashrate consistently on the rise.

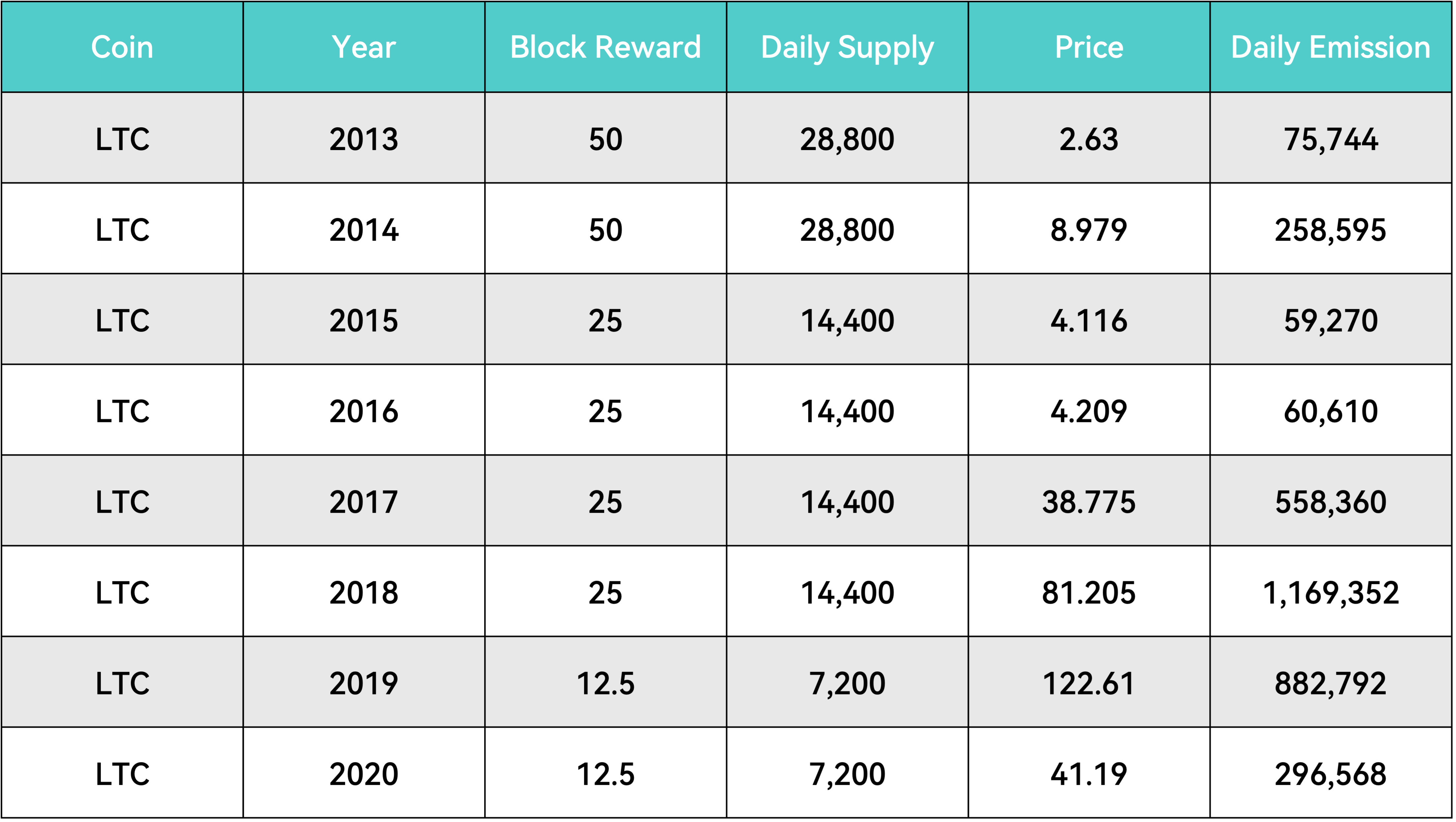

From 2011 to 2020, Litecoin underwent two halving events, in 2015 and 2019, reducing its daily supply from 28,800 LTC to 14,400 LTC and then to 7,200 LTC. During this period, LTC's price saw significant increases, particularly in 2014 and between 2017 and 2019, leading to a substantial boost in daily mining revenue. In 2018, LTC’s daily emission even surpassed $1 million, marking it as one of the few mining coins to reach this milestone at the time.

Estimation of LTC’s Daily Emission (2013-2020)

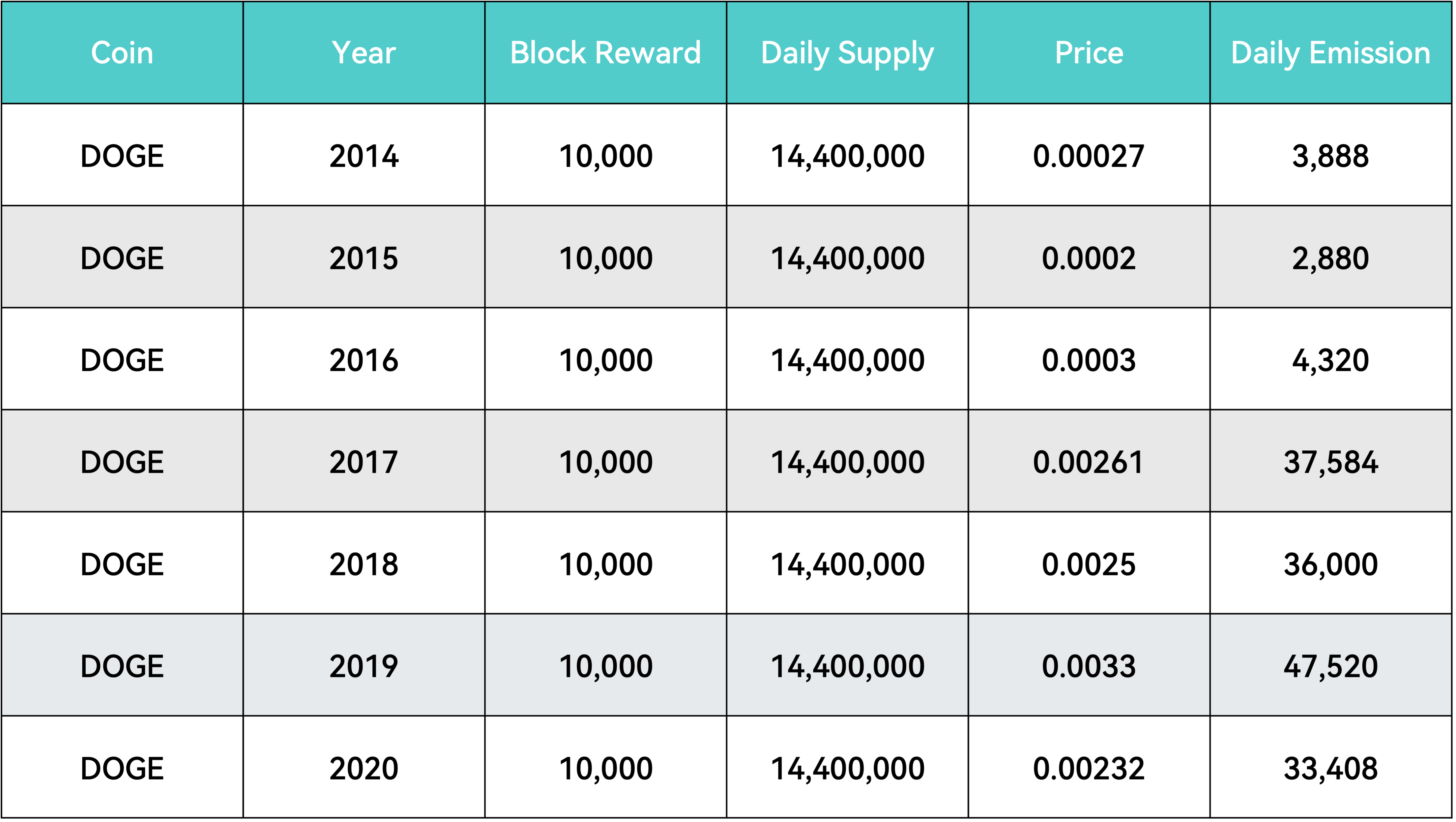

Even though DOGE began merged mining with LTC in 2014, its low price kept its highest daily emission under $50,000. As a result, LTC miners primarily earned from LTC during this phase, with LTC accounting for over 90% of their total income.

Estimation of DOGE’s Daily Emission (2013-2020)

"Meme Coin" Frenzy Phase

In 2019, Elon Musk expressed his fondness for Dogecoin, as the market still saw it as a novelty. However, by 2021, Musk’s frequent endorsements on social media, along with support from various celebrities and increasing merchant acceptance, propelled Dogecoin’s reputation and price to new heights. By 2021, DOGE’s daily emission exceeded that of LTC, soaring to over $3 million.

In contrast, Litecoin’s price remained relatively stable, diverging sharply from its previous growth trend. By 2022, LTC’s daily emissions stabilized at around $400,000. As a result, DOGE became the primary income source for LTC miners, contributing more than 70% of their total earnings, while LTC’s share dropped to 20%-30%.

Estimation of LTC and DOGE’s Daily Emission (2021-2023)

Inclusion of BELLS: The Diversified Earnings Phase

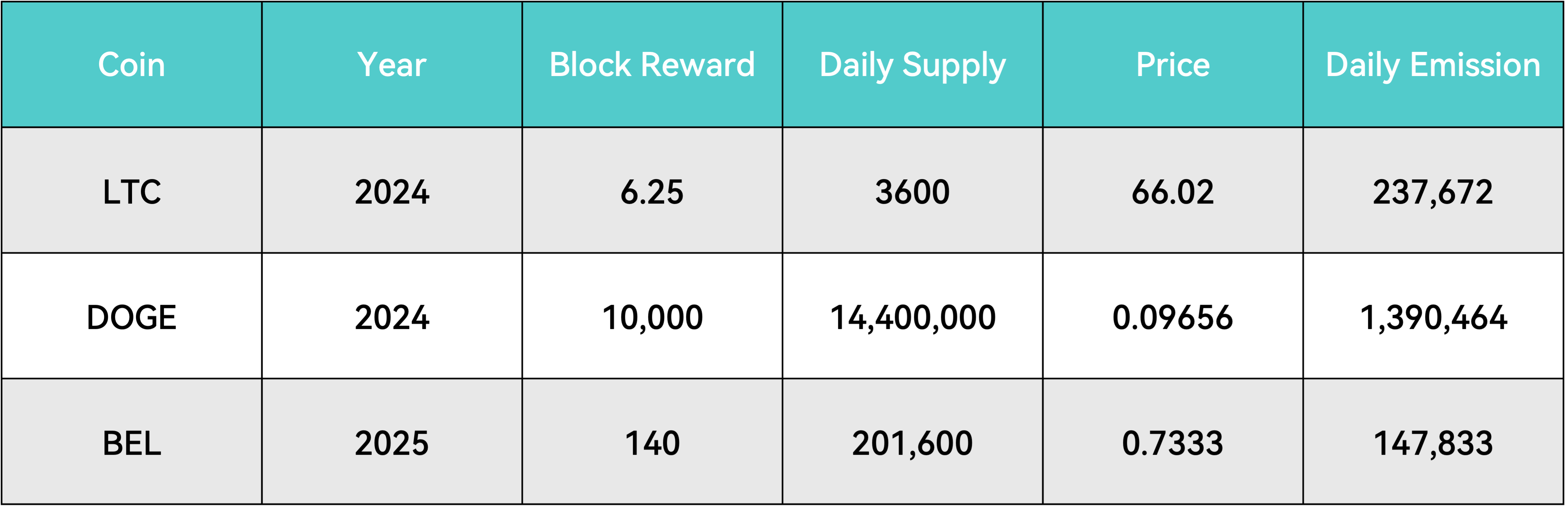

In 2024, the re-emergence of Bellscoin (BELLS) has provided new opportunities for LTC miners. Although BELLS and DOGE originate from the same founder and are often considered sister projects, BELLS only began to gain traction and recognition towards the end of 2023.

On August 18, 2024, BELLS introduced merged mining, allowing miners to simultaneously mine BELLS and LTC without additional costs. This initiative increased the total revenue of LTC miners by nearly 10%. As a result, miners' confidence grew significantly, and on August 22, LTC's network hashrate reached a record high of 1.23 PH/s.

Estimation of LTC/DOGE/BELLS Daily Emission (2024)

Currently, DOGE contributes 78% to LTC miners' daily revenues, LTC's share has dropped to 13%, and BELLS, recently added, makes up 8%. This shift indicates a more diversified income structure for LTC miners, evolving from an initial sole reliance on LTC to DOGE dominance and now including BELLS.

Nevertheless, miners face challenges as BELLS is set for two significant reductions, each approaching 90%. Additionally, LTC will undergo another halving in 2027, which could further reduce LTC miners' daily revenue if the price remains stagnant.

Historical Changes in LTC Miners' Daily Emission

For LTC miners, quickly adopting BELLS mining is increasingly important. Currently, ViaBTC, a leading LTC mining pool, is offering a zero-fee BELLS mining option, providing a valuable opportunity for miners seeking to enhance their earnings. For more information, visit: www.viabtc.com