Over the past year, CKB's price has surged by more than 300%, with the total network hash rate soaring from 150P at the start of the year to 400P. This makes it one of the standout currencies in the cryptocurrency market. This significant growth is due to Nervos Network's launch of the RGB++ new asset protocol on the mainnet earlier this year, repositioning itself as Bitcoin's Layer 2. This strategic shift in the thriving Bitcoin ecosystem has heightened investor expectations for CKB's future development.

This article aims to provide an in-depth look at Nervos Network, covering its background, core technology, token distribution mechanism, and mining methods. It seeks to help miners and investors fully understand CKB, enabling them to make more informed decisions.

What is Nervos Network?

Founded in 2018, Nervos Network's founding team consists primarily of early participants from the Ethereum community. The Nervos team aims to build an innovative modular blockchain network featuring a two-layer architecture: Layer 1 ensures the network's security and decentralized storage, while Layer 2 and additional layers handle high-frequency transactions and complex computations. This design boosts the network's processing capacity and speed, achieving scalability.

In 2019, Nervos Network launched its Layer 1 network, the Common Knowledge Base (CKB). Interestingly, despite the Nervos team's close ties with the Ethereum ecosystem, they chose a different development path. Adhering to censorship resistance, permissionless access, and high decentralization principles, the Nervos team opted for the exact PoW consensus mechanism as Bitcoin to ensure Layer 1's security and stability.

Core Technology of CKB: The Cell Model

CKB not only mirrors Bitcoin's consensus mechanism but also draws significant inspiration from Bitcoin's core data structure. While the industry predominantly uses Ethereum's accounts-based model, where user assets are managed in smart contracts, CKB adopts an enhanced version of Bitcoin's UTXO (Unspent Transaction Output) model, known as the "Cell model."

In the Cell model, the network state is broken down into basic units called "Cells." Each Cell contains data and maintains a unique state, storing information such as token amounts and smart contract codes. Once created, a Cell's data is immutable. To update information, the current Cell is consumed, and a new Cell is generated.

This Cell model, built on the improved UTXO model, offers higher asset issuance security than Ethereum's accounts-based model. Additionally, it provides greater flexibility, supporting complex operations and smart contract implementations. For example, users can combine multiple Cells to construct intricate transaction and operation logic. Smart contract code can be directly stored in Cells, invoked, and executed through transactions.

CKB in the Bitcoin Ecosystem: RGB++

RGB++ is an innovative asset issuance standard proposed by Nervos co-founder Cipher Wang, designed to enhance Bitcoin's capabilities on CKB. The original RGB protocol, despite its advanced concept, struggled with adoption due to issues like client data silos, requiring users to run their own clients and back up data, thus increasing the usage barrier.

Building on the original RGB protocol, Cipher Wang leveraged CKB's Cell model and its similarity to Bitcoin's UTXO structure, using homomorphic binding technology to map and bind Bitcoin's UTXOs with CKB's Cells. This design enables CKB to handle essential information such as asset states, contract issuance, and transaction verification for RGB. This means that a Bitcoin client runs on CKB as a third-party data hosting and computation platform, removing the need for users to run their own RGB clients.

CKB's high scalability supports more smart contract functions than the native Bitcoin network. Consequently, many are optimistic about CKB's future within the Bitcoin ecosystem, seeing it as a potential key component.

CKB's Issuance Mechanism

As of June 28th, the total issuance of CKB has reached 45.13 billion, with about 44.45 billion in circulation. CKB's issuance is divided into the genesis block, primary issuance, and secondary issuance.

In the genesis block, a total of 33.6 billion CKB were issued. Of these, 8.4 billion were transferred to Bitcoin founder Satoshi Nakamoto's address as a tribute. Since Satoshi's address has been inactive for a long time, this portion is considered permanently locked. The remaining 25.2 billion CKB were distributed to Nervos's institutional investors, development team, ecosystem fund, and public investors.

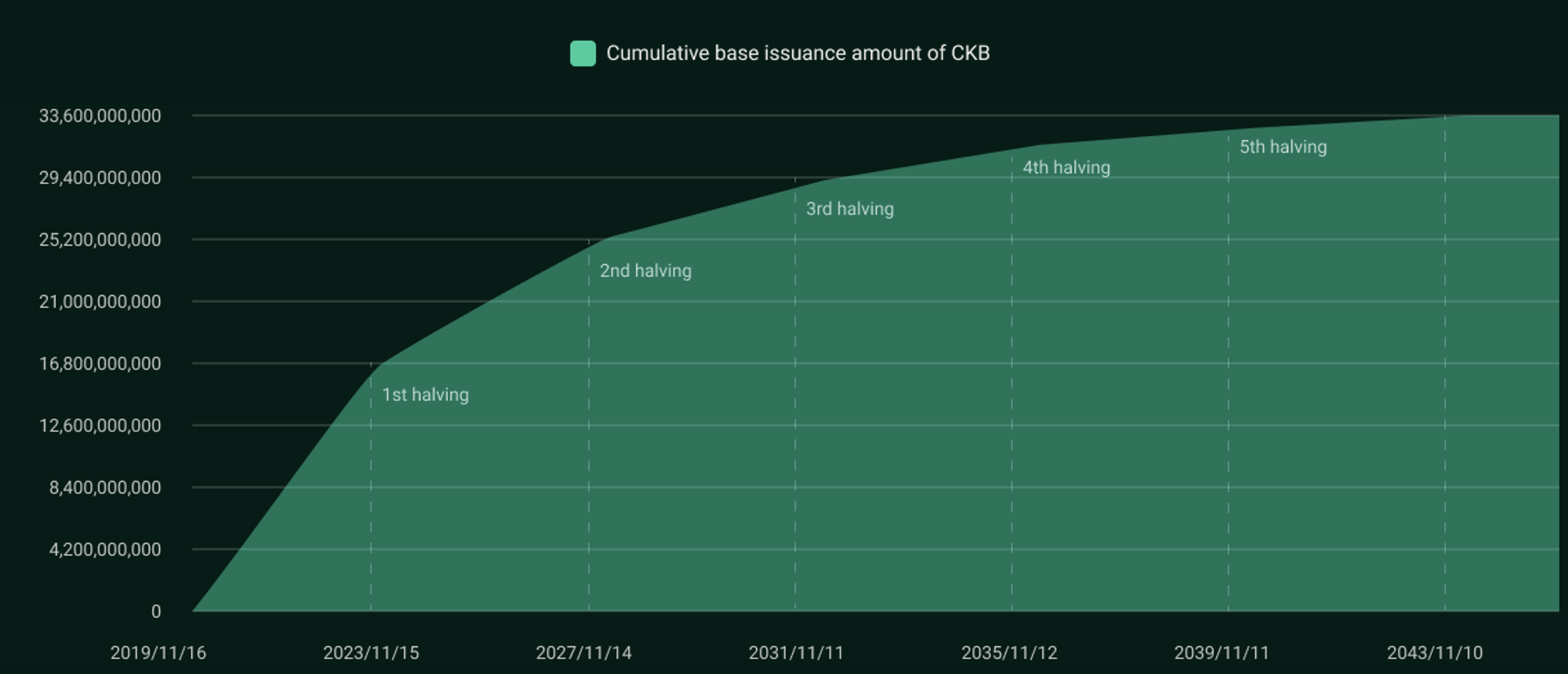

In the primary issuance, CKB's mechanism resembles Bitcoin's block rewards. Over approximately 84 years, 33.6 billion CKB will be issued as mining rewards. Each Epoch (about 4 hours) produces 1,917,808 CKB. Every 8,760 Epochs (approximately every four years), the rewards are halved until the issuance is complete. CKB underwent its first halving event last November.

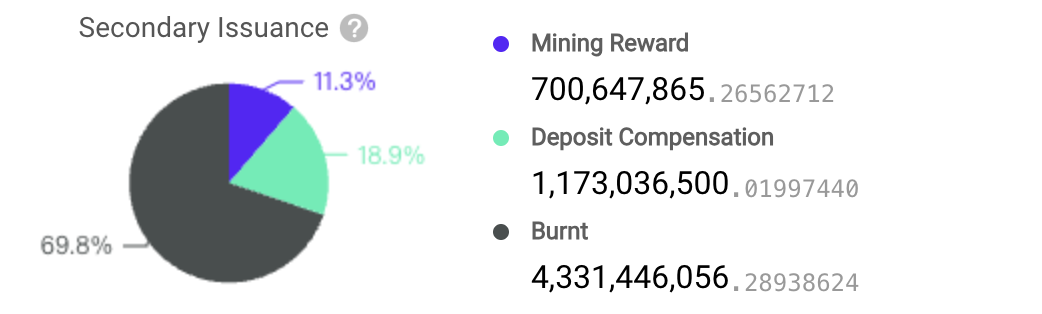

The secondary issuance involves a fixed annual issuance of 1.344 billion CKB. These tokens are allocated based on the proportion of the issued amount used on-chain. For instance, if 10% of the issued CKB is used for on-chain state occupancy and 20% is locked in the Nervos DAO, miners receive an additional 134.4 million CKB (10%) annually as rewards, while Nervos DAO depositors split about 268.8 million CKB (20%). The remaining 70% of the secondary issuance goes into the treasury, which is currently burnt due to the incomplete governance mechanism.

As of June 28th, miners have received 11.3% of the secondary issuance rewards, Nervos DAO depositors have received 18.9%, and the remaining 69.8% has been burnt.

How to Mine CKB

Currently, the total network hashrate of CKB is about 380P. At the current price of $0.012 per CKB, the daily output value of the entire network is approximately $70,000, translating to a daily income of about 15.52 CKB per 1TH/s, or roughly $0.18.

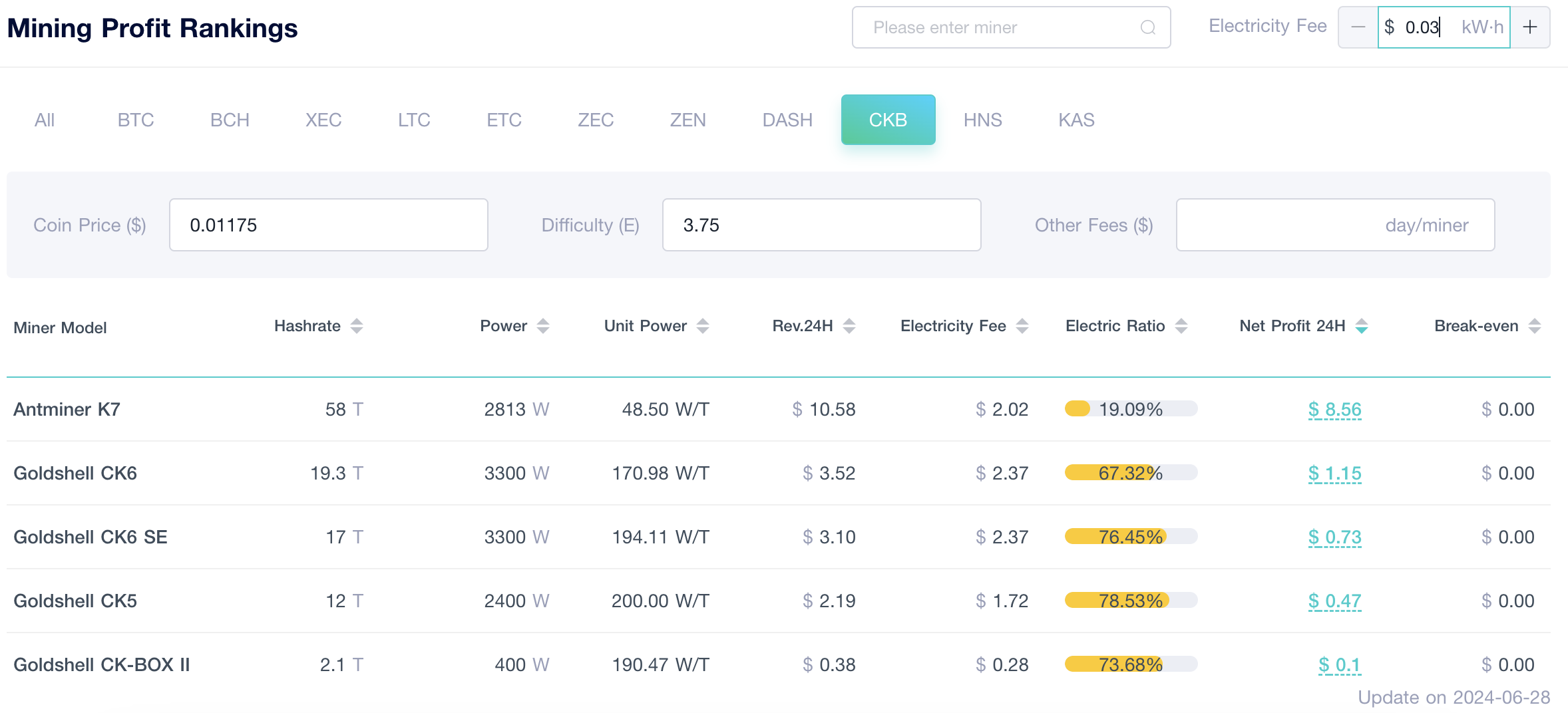

As CKB has rapidly developed, mining rigs have also advanced quickly. By 2020, CKB mining had entered the ASIC device stage. Miners can refer to ViaBTC's mining profit rankings to find the most suitable equipment for CKB mining. However, with the current electricity price at $0.03/kWh, only the Antminer K7 shows ideal profitability; other mining machines may not cover electricity costs if the price exceeds this standard.

Given the intense competition and increasing difficulty in mining, solo mining might struggle to achieve stable income. For miners with lower hashrates, joining a mining pool is a more practical choice, helping them consistently earn block rewards in CKB mining. ViaBTC supports CKB mining and offers two payment methods, PPLNS and Solo, enabling miners to choose the mode that best suits their needs.

Overall, the scalability, security, and decentralization offered by Nervos Network's Cell model and multi-layer architecture, along with the support of the RGB++ protocol, continue to boost CKB network activity. If CKB's price continues to rise, it will create an even more favorable situation for miners.