Born against the backdrop of the 2008 financial crisis, Bitcoin carried the hope for the ultimate replacement of the legacy financial system. For most of its existence, Bitcoin exhibited little correlation with stock markets. In recent years, however, as more institutional and retail investors flooded into the crypto market, we have started to notice a growing connection between Bitcoin and stock markets.

This is especially true in 2022 when Bitcoin showed a pronounced correlation with stock prices. According to historical price charts on TradingView, it’s clear that Bitcoin is strongly correlated with S&P 500 (SPX) and Nasdaq 100 (NDX).

Time range: January 1, 2022 - January 1, 2023, Source: TradingView

This strong correlation can also be found between the stock prices of crypto mining companies and the BTC price. As these companies chiefly profit from mining Bitcoin and other cryptos, when the BTC price rises, their operations become more lucrative, making their stocks more valuable.

To better demonstrate the level of correlation between the stock prices of crypto mining companies and the BTC price, let’s introduce the concept of correlation coefficients.

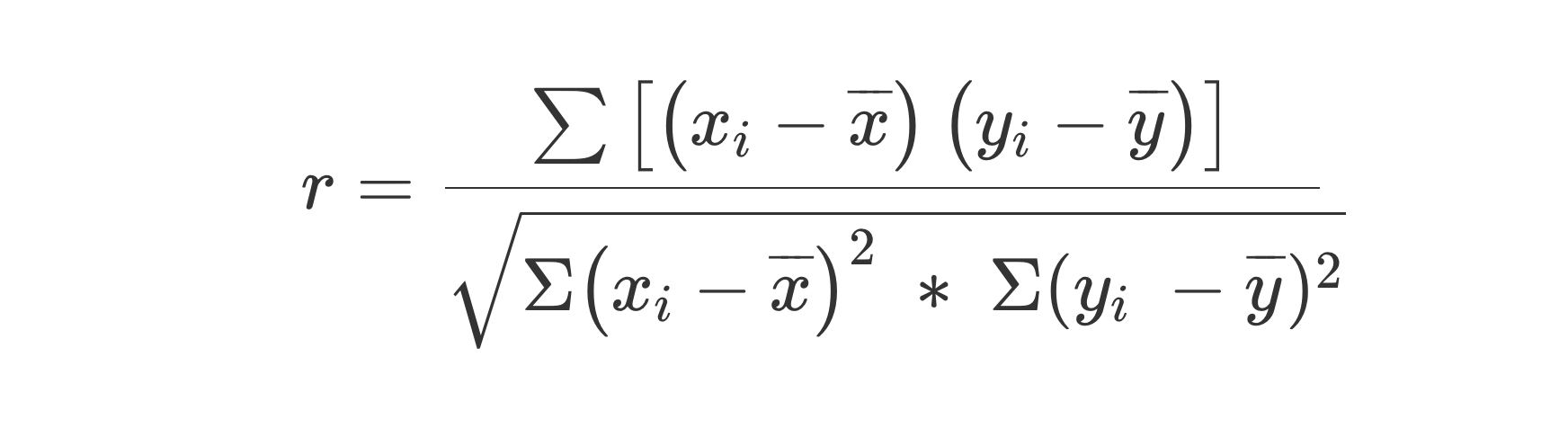

Correlation Coefficients:

Correlation coefficients are used to measure the strength of the linear relationship between two variables in quantitative correlation analysis. A correlation coefficient is represented by r, with values ranging from -1 to 1.

Correlation Coefficient Formula

A correlation coefficient of 1 indicates a perfect positive linear relationship between the two variables, meaning that they move in exactly the same direction. The closer the r value is to 1, the stronger the positive correlation. A correlation coefficient of -1, on the other hand, shows a perfect negative linear relationship. This means that the two variables move in completely opposite directions. The closer the r value is to -1, the stronger the negative correlation.

A correlation coefficient of nearly 0 suggests that almost no linear relationship exists between the two variables, i.e., their movements are not correlated.

Samples:

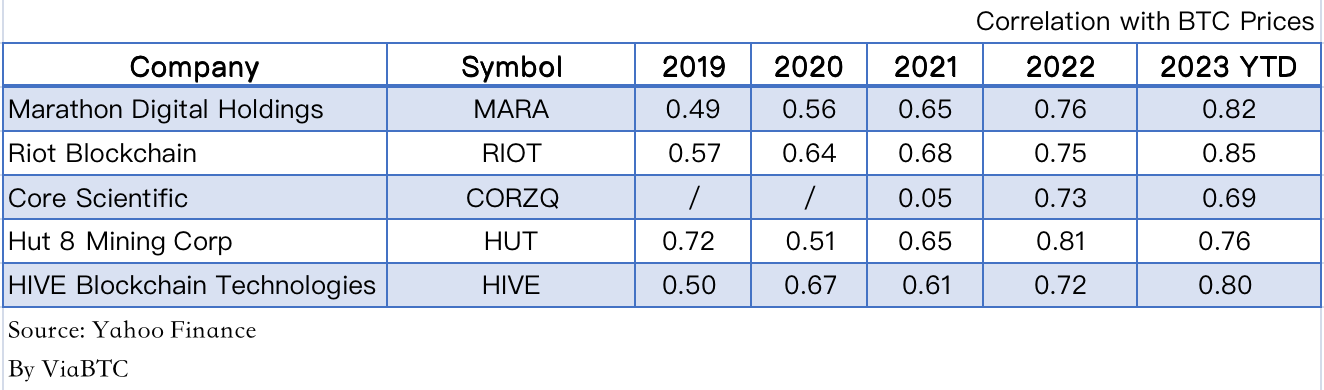

We selected five crypto mining companies (Marathon Digital, Riot Blockchain, Core Scientific, Hut 8, and HIVE Blockchain Technologies) to verify our hypothesis. According to their stock prices and BTC prices from 2019 to 2023, we can get the following results using the above formula:

According to the table above, we can tell that at the current stage, the correlation coefficients between the stock prices of the five listed crypto mining companies and the BTC price range roughly from 0.7 to 0.85, which indicates a very high positive correlation. As a result, investors now believe the BTC price to be a key indicator of the stock prices of crypto mining companies, as it reflects the overall demand for crypto and market status.

That said, it is important to note that the stock prices of crypto mining companies are not solely correlated with the BTC price. Other factors, including business performance, market competition, and industry prospects, can also have an impact on their stock prices. As such, before making a final decision, investors should account for factors beyond just the BTC price to fully evaluate the potential value and risks of crypto mining companies.

It should be noted that as Bitcoin gradually becomes a mainstream asset, a growing number of people are recognizing crypto as an excellent store of value. Furthermore, some companies, such as Tesla, MicroStrategy, and Meitu, have started adding more Bitcoin to their balance sheets.

Michael Saylor, CEO of MicroStrategy, has adopted Bitcoin as the company’s primary treasury reserve asset. According to the relevant figures, as of July 31, 2023, the company holds 152,800 bitcoins, which are now valued at about $3.865 billion. At the moment, MicroStrategy’s stock value is primarily based on its massive Bitcoin holding. In other words, its stock price is highly correlated with the BTC price, with a coefficient of 0.9. This level of correlation has even surpassed the figure observed in some companies exclusively involved in the Bitcoin business.

In recent years, we have seen temporary correlations between Bitcoin and many other factors. Most typically, major fluctuations of the U.S. stock market have had an impact on the BTC price. Despite that, it is important to acknowledge that due to the uniqueness of the crypto market and its short history, a longer timeframe and more data are needed to determine the durability and consistency of such correlations.

*Disclaimer: The article is for reference only and offers no financial advice.