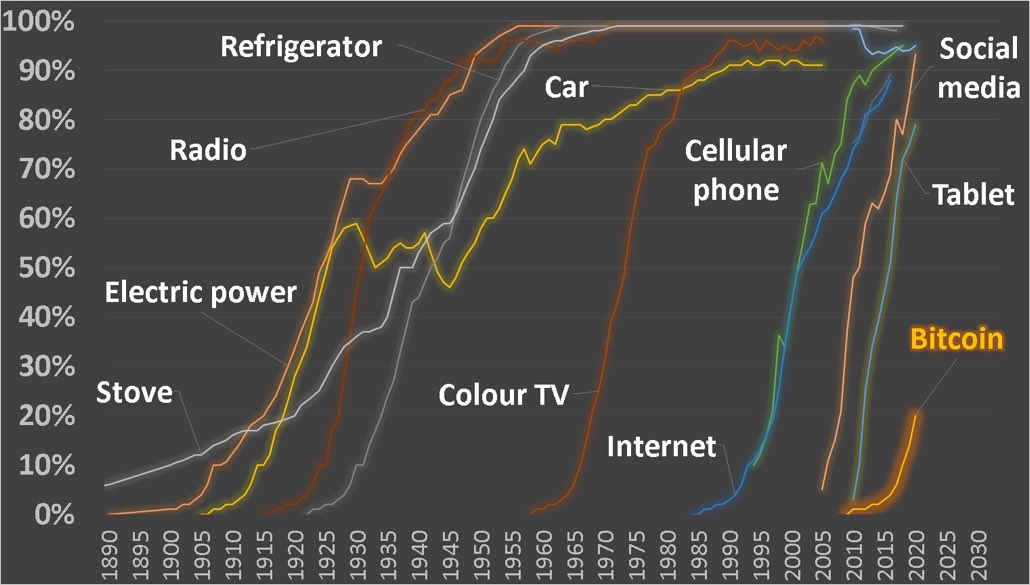

It took nearly 70 years for cars to achieve global adoption;

Color TVs became popular worldwide in over three decades;

The Internet gained universal popularity in more than 20 years;

It normally takes decades of development for such epoch-making products to penetrate global markets. In this article, we will focus on Bitcoin, which just celebrated its 14th anniversary. Will Bitcoin define the trends of our time? Could it also become part of our everyday life like cars and color TVs?

Let’s first recap the history of Bitcoin.

An anonymous technology geek named Satoshi Nakamoto published a paper titled Bitcoin: A Peer-to-Peer Electronic Cash System on the P2P Foundation website on October 31, 2008. The paper illustrated how to use a peer-to-peer network to build an electronic transaction system that does not depend on credits.

On January 3, 2009, Satoshi Nakamoto mined the genesis block (block #0) on a server in Helsinki and obtained the first block reward (50 BTC) from the network. Back then, the world was swept by a rare financial crisis, and millions of people lost their jobs and went bankrupt. Interestingly, permanently embedded in block #0 was a quote, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” which is the front-page headline of The Times the day the genesis block was mined, and that might be Satoshi’s way to express his dissatisfaction with central banks.

At the time, amidst the repeated financial crises and the unprecedented level of inflation, people’s wealth kept depreciating, and Satoshi Nakamoto wanted to create a super-sovereign currency that does not depend on any national authority or credit reporting agency. Ideally, that super currency will not depreciate due to an excessive money supply and will be available to everyone around the world. Satoshi Nakamoto envisioned a currency that will truly belong to all mankind. He pinned his hopes on Bitcoin, wishing that it could eventually be adopted worldwide and evolve into a commodity-based distributed global transaction system.

After 14 years of development, Bitcoin has survived the doubts, criticisms, and even abuses in the early days and grown into a mainstream store of value. Today, a growing number of countries have adopted Bitcoin as their legal tender, and it is no longer an energy-intensive toy with no real value. Despite the surge in value, Bitcoin still has a long way to go before it can realize Satoshi’s vision and become a distributed global transaction system based on commodities.

Data from Statista shows that of the 2,000 to 12,000 respondents aged between 18 to 65, 6% of the respondents in the United States owned or used cryptocurrencies in 2019. The figure remained unchanged in 2020, surged to 13% in 2021, and rose to 16% the year next. We can tell that small as the figure could be years ago, the share of U.S. respondents who owned or used cryptocurrencies has been on a steady rise since 2020, and other countries have also seen a similar trend.

Source: statista.com

Around the world, most places do not provide BTC payment channels because of the crypto’s limited payment scenarios, and most individual and institutional investors and governments regard Bitcoin as a special commodity with a store of value. Meanwhile, the regulatory framework for cryptocurrencies such as Bitcoin still needs plenty of improvements.

Secondly, compared with commodities like gold, Bitcoin is subject to volatile price swings, and government policies and regulations have direct impacts on the BTC price. For the general public, drastic changes in the value of their cash money are simply not acceptable, which is also the primary stumbling block preventing Bitcoin from becoming an everyday payment method.

Yet still, it should be noted that Bitcoin can always be upgraded. Segregated Witness (SegWit) has made it cheaper to trade Bitcoins; the birth of the Lightning Network has enabled everyday small Bitcoin transactions; the Taproot upgrade created unlimited possibilities for Bitcoin to scale. As more bitcoins are mined, BTC, which features a constant supply, might become a stable store of value like gold. By then, Bitcoin may finally realize Satoshi’s vision as a distributed transaction system used in every corner of the world.